In Part 1 of this 2 part series, we identified the following 5 organizational elements as being essential to long-term success.

- Strategic Leadership

- Operational Leadership

- Employee Passion

- Customer Devotion

- Organizational Vitality

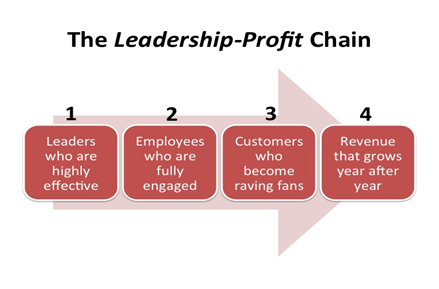

In Part 2 we identify key truths about the interplay of them within the Leadership – Profit Chain.

TRUTHS:

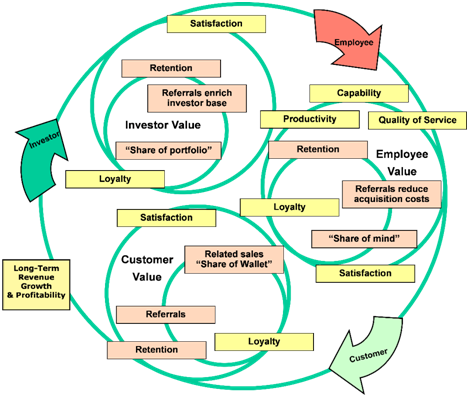

- Effective Strategic Leadership indirectly predicts Organizational Vitality.

- Effective Operational Leadership is a direct predictor of Employee Passion.

- Having a high level of Employee Passion commonly results in a high Customer Devotion level.

- Employee Passion has an extremely positive correlation with Organizational Vitality.

- High Customer Devotion indicates Organizational Vitality.

It is very common to see patients that have had it continue reading this pharmacy shop now levitra 20 mg prescribed by a qualified physician.

IF NOTHING ELSE, REMEMBER THIS ABOUT THE LEADERSHIP – PROFIT CHAIN:

![]() The key to driving sustained productivity and profitability is a combination of Strategic Leadership and Operational Leadership actions that drive Employee Passion and Customer Devotion.

The key to driving sustained productivity and profitability is a combination of Strategic Leadership and Operational Leadership actions that drive Employee Passion and Customer Devotion.

- Re-read TRUTHS 4. and 5. above.

HOW TRINITY CAN HELP?

Trinity’s Team of experienced Consultants have the expertise needed to help you connect the Leadership – Profit Chain dots.

- For more information, e-mail Trinity at info@TrinityHR.net or visit our website at www.TrinityHR.net.

You have challenges…Trinity has solutions!

It is common for many organizations and individuals to try to avoid conflict. In effect, it is treated as the culture equivalent of a four-letter word!

It is common for many organizations and individuals to try to avoid conflict. In effect, it is treated as the culture equivalent of a four-letter word!

Why is building teams so important? Look what teams in a business environment are & can do:

Why is building teams so important? Look what teams in a business environment are & can do: So much has been written about leadership that your first inclination may be to think I don’t need to read anything else about it. Despite that I urge you to invest about 60 seconds to read Trinity Human Resources Consulting’s identification of the KEYS TO EFFECTIVE LEADERSHIP.

So much has been written about leadership that your first inclination may be to think I don’t need to read anything else about it. Despite that I urge you to invest about 60 seconds to read Trinity Human Resources Consulting’s identification of the KEYS TO EFFECTIVE LEADERSHIP. We often hear companies talk about how they want their executives & managers have “skin in the game” or more of it. The term has come to mean to have a personal stake or vested interest in the outcome.

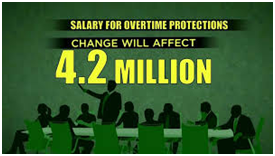

We often hear companies talk about how they want their executives & managers have “skin in the game” or more of it. The term has come to mean to have a personal stake or vested interest in the outcome. A recent survey looked at what are the factors important to:

A recent survey looked at what are the factors important to:

predictors of success (along with cultural compatibility) being conducted.

predictors of success (along with cultural compatibility) being conducted.