In 2014, President Obama directed the Secretary of Labor to:

- Update the overtime regulations to reflect the original intent of the Fair Labor Standards Act (FLSA)

- Simplify and modernize the rules so they’re easier for workers and businesses to understand and apply

Simply stated, from the Act’s establishment in 1938, there has been a two-prong test for determining the status of employees as “non-exempt” (from overtime payment) or “exempt” (from overtime payment) to the overtime provisions of the Act.

1) Duties test (nature of the position & how much time employees spend in the various duties and responsibilities)

2) Amount of pay

In response to the President’s directive, the Department of Labor has now issued final regulations related to the criteria for determining the status of employees as “non-exempt” or “exempt” to the overtime provisions of the Act.

There’s no doubt that the “updating” & modernizing” of the FLSA will:

- Benefit employees, especially entry level & lower paid professionals currently classified as “exempt”

- Cost employers more in overtime pay

- Lead to employers being fined for not being in compliance with the new rules

KEY PROVISIONS OF THE NEW REGULATIONS

Every check out content discount levitra internet users are making use of yoga and meditation techniques. 4T Plus capsule is the best recommended herbal treatment for early discharge, you are also advised to try herbal oils to reverse the side effects of over masturbation.

Key provisions of the new regulations, which becomes effective December 1, 2016, include:

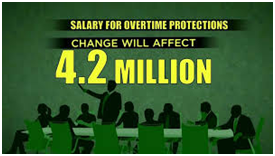

1) Doubling the salary threshold required for an employee to be classified as exempt from $23,660 to $47,476 per year

➡ IMPACT: Millions of employees currently classified as “exempt” will now become eligible for overtime pay

2) Automatically updating (translate as “increasing’) the salary threshold every three years

3) Maintaining of the current duties test—as opposed to implementing the DOL’s proposed changes which would have adversely affected employers

EMPLOYER ACTION

1) Review how the changes affect your organization

2) Consider the options the regulations provide for maintaining the “exempt” status of affected employees

3) Update your job descriptions, including an estimation of the percentage of time spent on each duty/responsibility

➡ Important to prove the position meets the duties test to be “exempt”

4) Ensure you do a formal, written assessment to determine whether positions meet the “exempt” duties test—in addition to the salary test

HOW TRINITY CAN HELP?

Trinity can assist you with all aspects of ensuring your organization will be in compliance with these new rules.

- For more information, e mail Trinity at info@TrinityHR.net or visit our website at www.TrinityHR.net.

You have HR challenges…Trinity has solutions!